Do You Know Your Social Security Options?

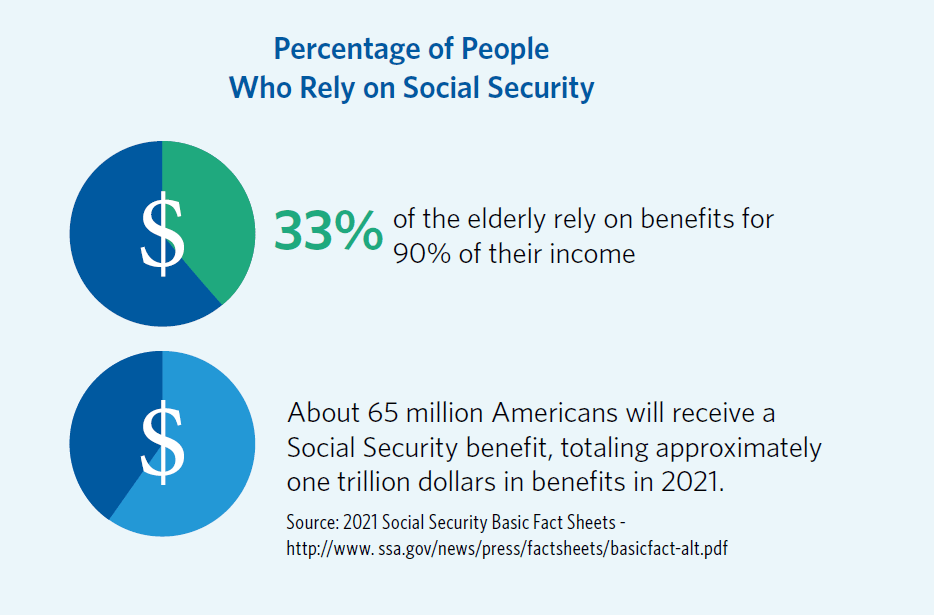

Social Security payments are a big part of many people’s retirement income –

and that may be the case for you.

If you’re nearing retirement or are already retired, you probably have several questions as it pertains to your Social

Security payments:

• How much could I receive in monthly benefits?

• What if I start taking my Social Security payments before I reach my full retirement age?

• What if I wait until my full retirement age to begin drawing my benefit? What will my benefit be?

• If I continue to work, how much of my Social Security benefit would be withheld?

• What happens when my spouse passes away?

How Are My Worker Benefits Calculated?

You can become eligible for Social Security benefits by working at a Social Security covered job for at least 10 years or until you have accumulated 40 quarters in the workforce. To calculate your benefit, 35 of your highest earnings years are averaged (if you haven’t worked for 35 years, your benefit will be averaged over the years you’ve worked, with the years needed to reach 35 counting as zero). In general, the more years you spend in the workforce and the higher your income, the higher your retirement benefit.

When Can I Start Receiving Benefits?

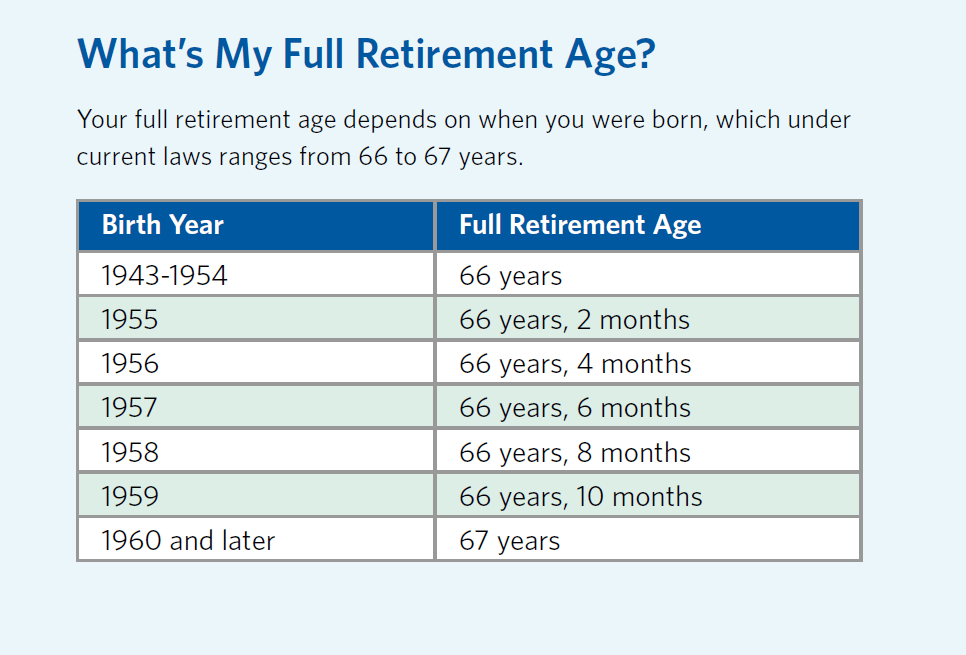

You can begin receiving Social Security payments at age 62, but if you do file at that age you’ll only get 75 percent of your full amount. If you wait past your full retirement age to begin receiving payments, you’ll get more than 100 percent of your benefit amount. File earlier; receive a smaller check for a longer period. Wait to file, and potentially receive a larger check and a larger survivor benefit for your spouse. An 8 percent delayed retirement credit will be added to your benefit for each year you delay receiving benefits after your full retirement age, which may enhance your benefit by as much as 32 percent.

Check this out!

Let us help YOU!

CONTACT M. Garrett Wheeler today. No cost/no obligation planning session with NO STRINGS ATTACHED.

As Mr. Wheeler points out, “Investments are a matter of opinion. Taxes are a matter of fact. When we are engaged by a client to deliver on our fee-based planning services, we start by making it 100% all about the client; not us!”

Wheeler goes on to say, “we focus on providing my clients with tax-reduction advice and strategies. Not on the latest financial product or investments (i.e. Crypto…).”

Understanding more about the U.S. tax system, how it works and getting ideas to help you maximize your income in retirement may be a conversation that you want to have. If it is the case, feel free to reach out to us. We can help you with all of this and make it relatively painless. We look forward to discussing your needs. Aloha!